- Home

- General Economy

- Blackstone signals the top thr ...

Global investment giant Blackstone suggests that opportunities lie within risky situations, however they also discuss the current crippling state of the global economy. These risks are:

- Inflation

- Inflation still hasn’t stopped rising, Blackstone expects inflation to keep rising, because rent and wages have increased drastically.

- There is no immediate anti-inflation policy set in-place by the government to aid high prices, especially due to the nation-wide US housing shortage (as a consequence of high rent prices)

- Blackstone predicts firm’s profit margins to reduce as a consequence of increasingly high inflation and interest rates, putting pressure on them to keep investors satisfied.

- Risk of a recession

- Higher risk for a recession in Europe due to the Russia-Ukraine war as there are increasingly higher energy prices.

- In addition to that, China has been seeing less than 3% growth per year, shocking the public on such a slowdown compared to previous years.

- A source from CNBC also confirms that the worst is yet to come by explaining how the US has just flipped the switch through an inverted yield curve.

- According to Bloomberg survey responses, around 60% of investors estimate the risk of a recession in the next 24 months.

- Global IR skyrocketing

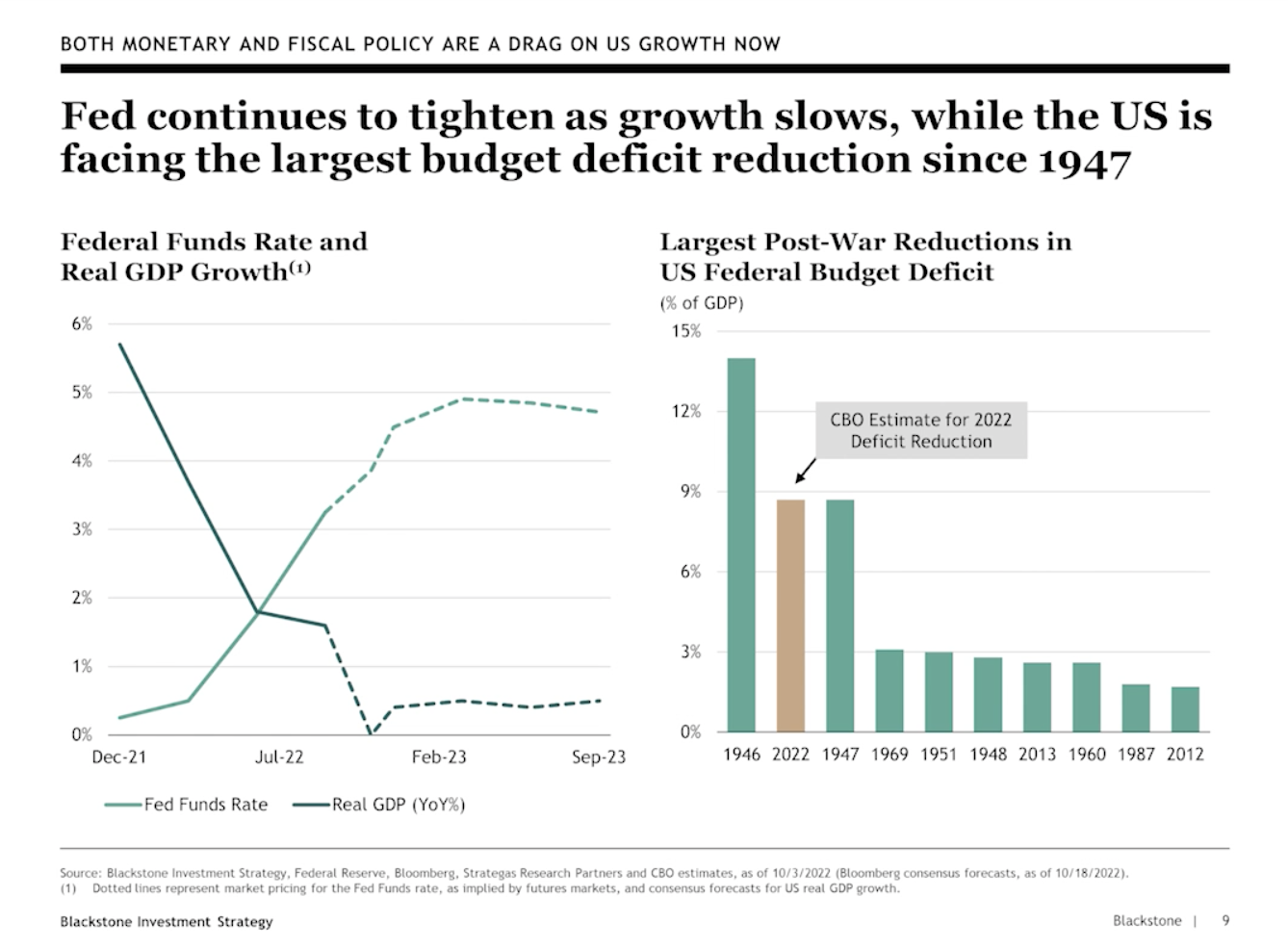

- Fed funds rate and inflation go hand-in-hand and no decreases are planned on happening any time soon.

What does this mean?

- With great risk comes great opportunity.

- Public sentiment is relatively low now, typically suggesting the potential for new and possibly unconventional methods of investing (i.e. art or even Pokemon cards)

- If these events turn out to be true, earnings will decrease drastically.

- Usually, if stocks tend to decrease, bonds tend to move in tandem.

- Valuations could be compromised due to the extremely volatile state of the economy.

- Lastly, this suggests that the US are going to further tighten their monetary and fiscal policies to further aid this situation. However, as we all know, printing more money leads to more problems; a double-ended sword.

If you would like to find out more about this then check out this post from Blackstone where the company hosts their fourth-quarter webcast featuring Private Wealth Solutions Chief Investment Strategist Joe Zidle and Vice Chairman Byron Wien.

https://www.blackstone.com/insights/article/blackstone-q4-2022-webcast/

Poll

Search

Recent Post

$APPL Equity Q2 2023 Report

- October 5, 2023

- 9 min read

Apple 2023 Executive Summary

- October 4, 2023

- 5 min read

M&A: Announced Pfizer Aquiring Seagen

- October 3, 2023

- 4 min read